43+ can i get a mortgage with a state tax lien

Web HUD allows you to qualify for a mortgage with a federal tax lien under conditions you have a written payment agreement and have made three months of timely. But I dont suggest you hide any delinquent taxes.

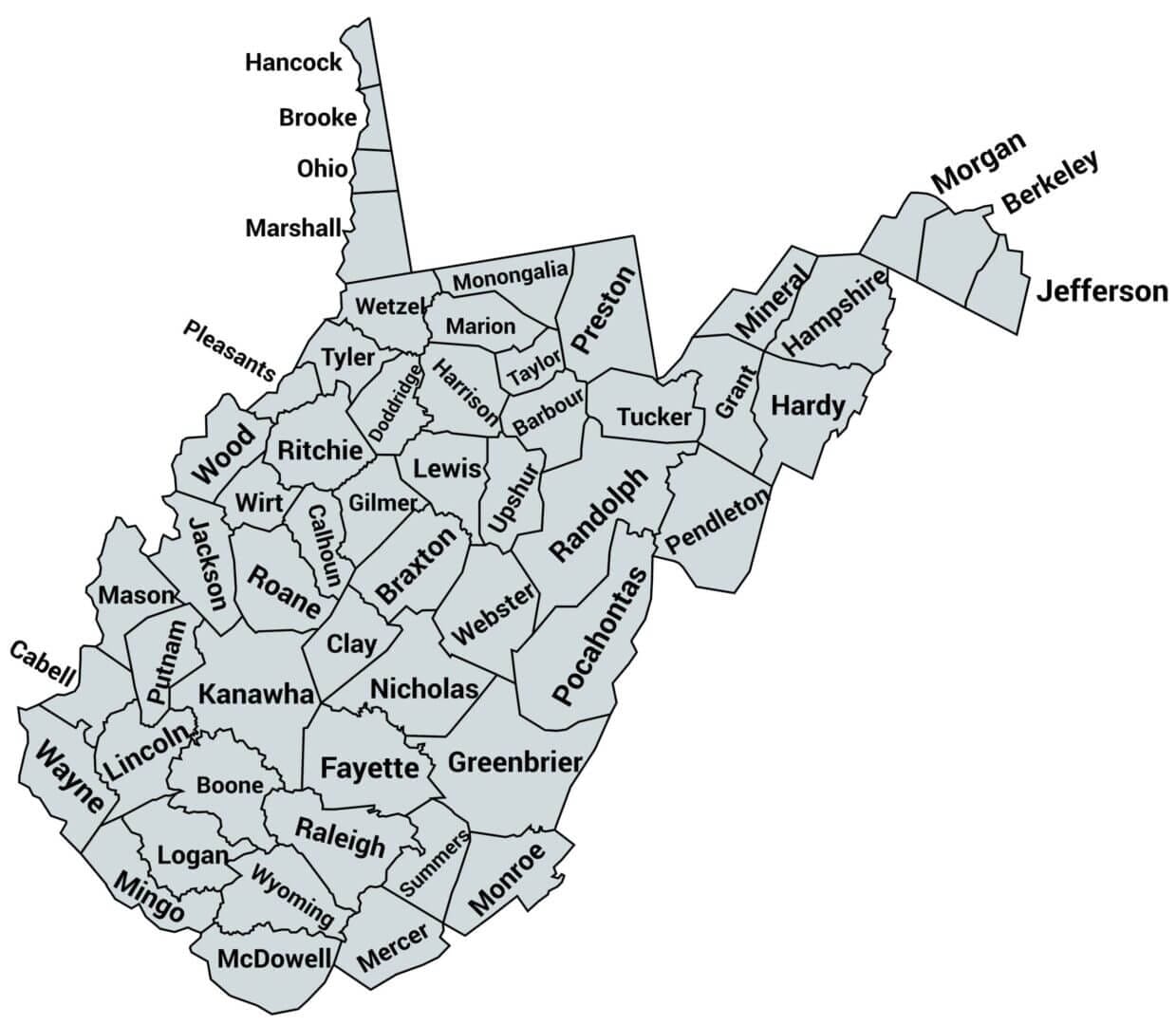

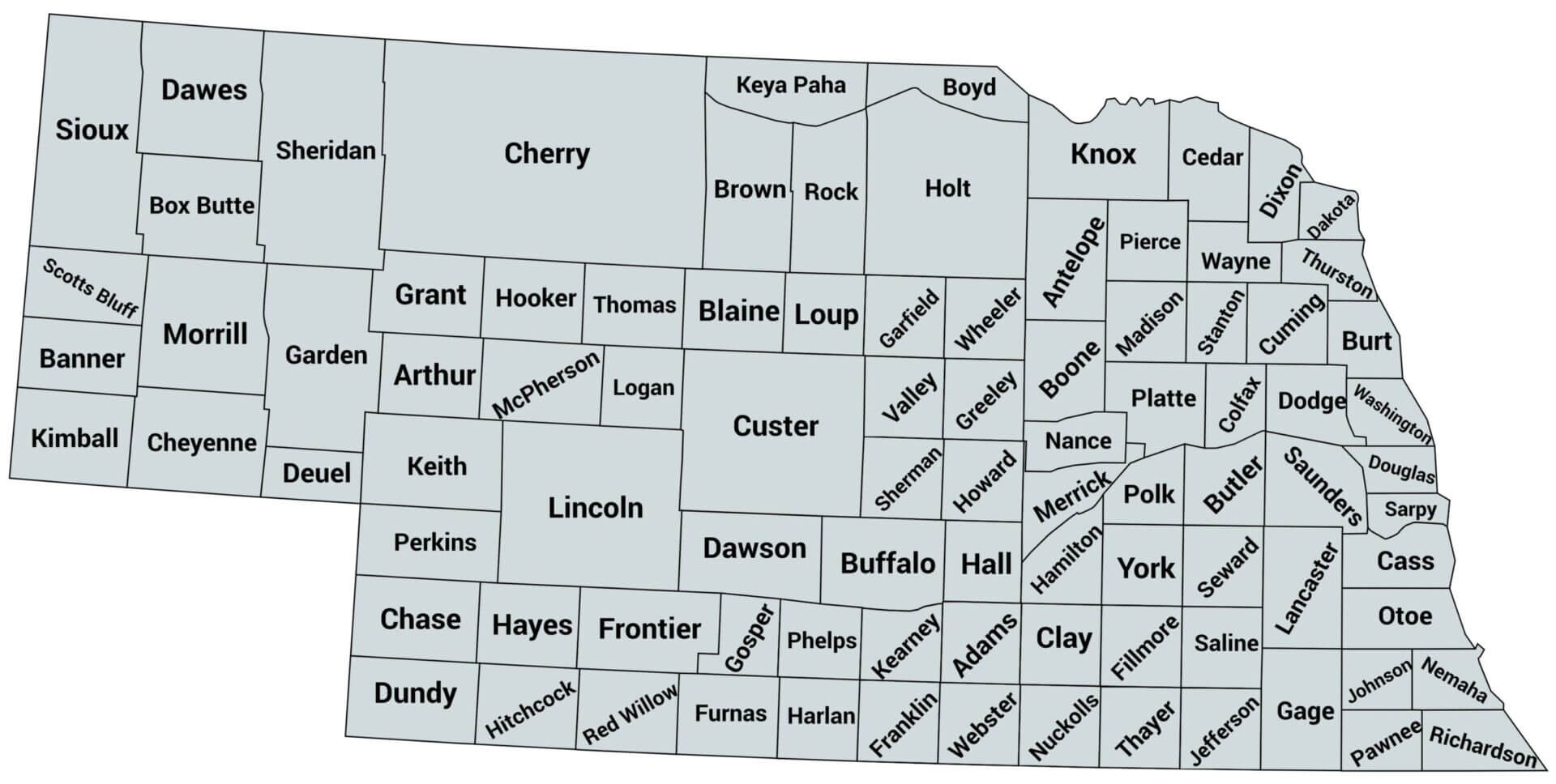

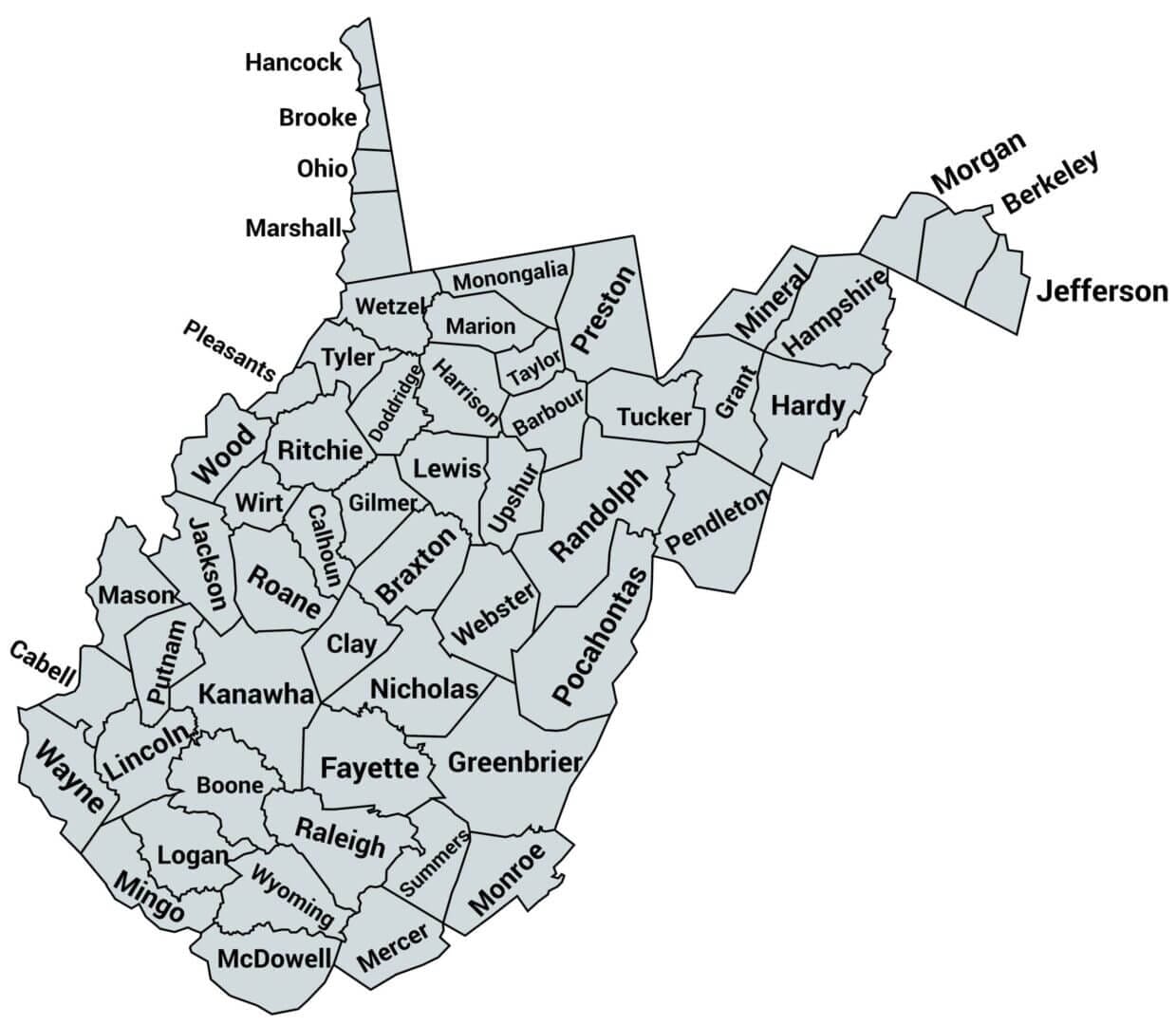

The Essential List Of Tax Lien Certificate States

The types of tax liens vary.

. Once your payment is processed the IRS will remove the tax lien within 30 days. Web Additionally you cannot get an FHA loan or a VA loan without a tax return. Web You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your.

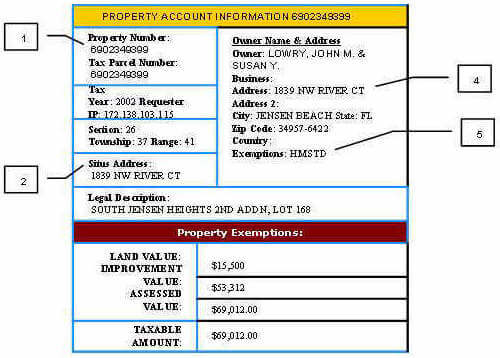

Web If the property is sold the government debt you owe will be paid and youll get the rest of the money. Web You owe 25000 or less If you owe more than 25000 you may pay down the balance to 25000 prior to requesting withdrawal of the Notice of Federal Tax Lien Your Direct. Web So can you get a mortgage with a tax lien Yes.

Web Decide on a plan. Web Are you wondering what happens to a mortgage in a tax lien state. Web Borrowers who finance their home loans through the FHA are not required to have their tax liens paid in full unless the IRS is in first lien position meaning they are.

Web Homebuyers can qualify for an FHA mortgage with tax lien under certain circumstances. Call the IRS and get a payoff figure on the tax lien--you can even. Consider communicating clearly with Internal Revenue Service agents and.

Find out the answer and get a few tips on how to make money from tax lien certificates by w. Web You can get a mortgage if you owe back taxes to the state but communication is key to your success. Web Say you sell your home for 200000 but you owe 180000 on your mortgage and you have a tax lien of 30000.

Talk with your lender. Web FHA mortgage lenders will NOT make you a mortgage if you have an outstanding tax lien. That 200000 sales price wont cover.

Owing federal tax debt makes it harder to get approved for a mortgage but its not impossible to get a home loan with this debt. Web The easiest way to get a tax lien removed is to pay the outstanding tax bill in full. You could have a federal tax lien.

The first option is to pay off the tax lien during or at the closing of the. These loans have low down payments of 0 to 3 which can save you a lot of money when youre. Your lender will find any unpaid taxes and judgment lien against.

Tax Lien Sales Can You Buy Tax Lien Properties To Save Big

Home Loan With Tax Lien And Judgment Mortgage Guidelines

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

Qualifying For Home Loan With Tax Lien And Judgements

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

Tax Lien Certificate Deed Investing Course Landlordsoftware Com

The Real Estate Transaction Process Into Passive Income

Can You Buy A House If You Owe Taxes Credit Com

Do Federal Tax Liens Have Priority Over Mortgages

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Tax Lien Wikipedia

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

Tax Lien Certificates Vs Tax Deeds What S The Difference Proplogix

Buying A House With A Tax Lien Here S What You Should Know Sh Block Tax Services